what is the inheritance tax in georgia

Tax rate of 1 on the first 1000 of taxable income. Learn about Inheritance tax on Georgia today.

How To Pay Less In Taxes Through Tax Residency In Georgia

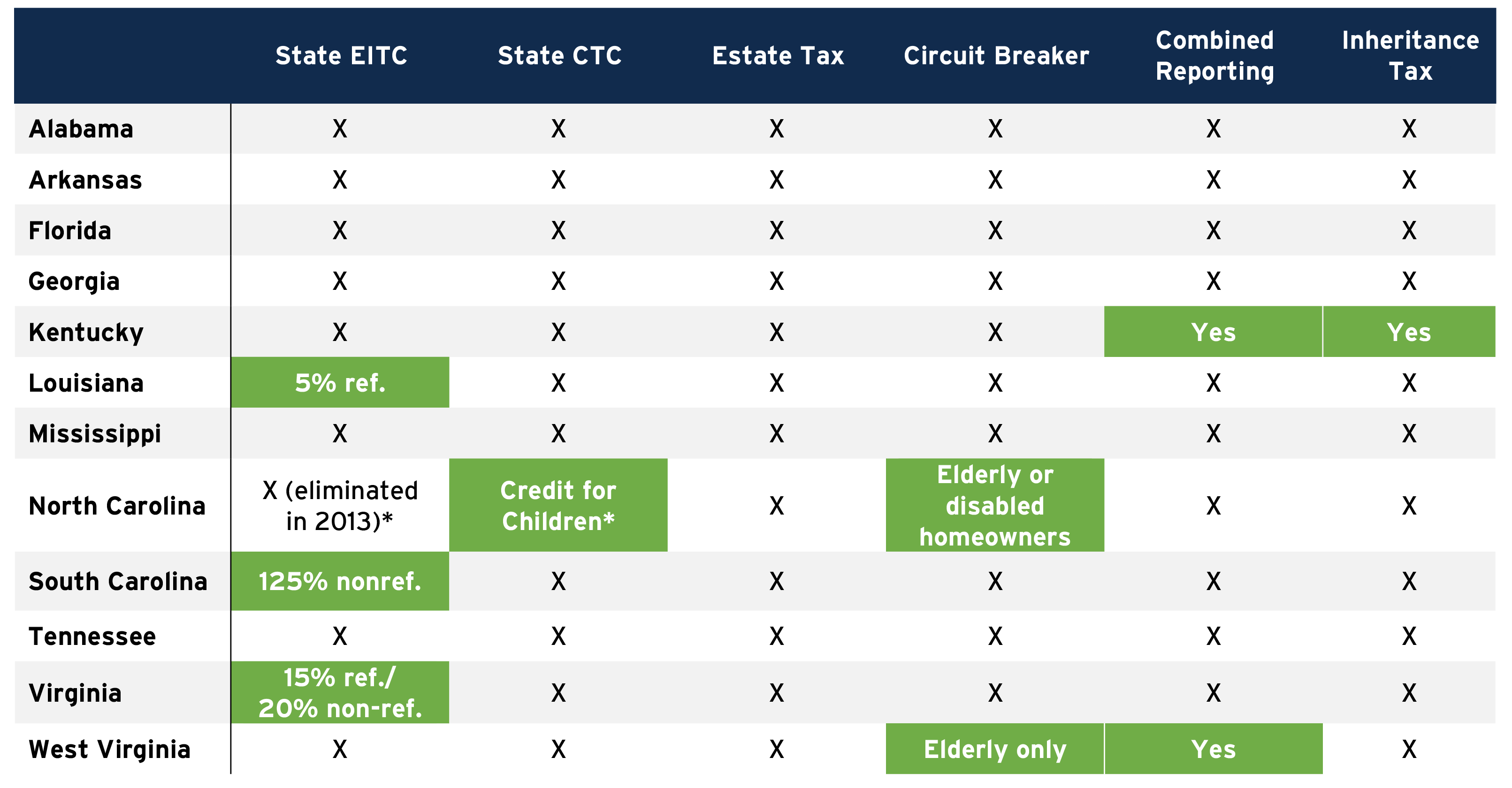

The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption.

. If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up to. It is not paid by the. Inheritance tax and inheritance law in Georgia Taxation Researcher November 01 2021 INHERITANCE TAX First and second degree relatives are fully exempt from inheritance taxes.

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. Georgia does not have an Inheritance Tax. If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of 5 of the fair market value.

Does Georgia Have an Inheritance Tax. The tax is paid by the estate before any assets are distributed to heirs. You must present it to the vendor when making a.

15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt. 45 percent on transfers to direct descendants and lineal heirs. If you are the recipient of money or property under the will of someone you need not even report the receipt of that money on your.

Legal advice on Inheritance tax in. No Georgia does not have an inheritance tax. Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax.

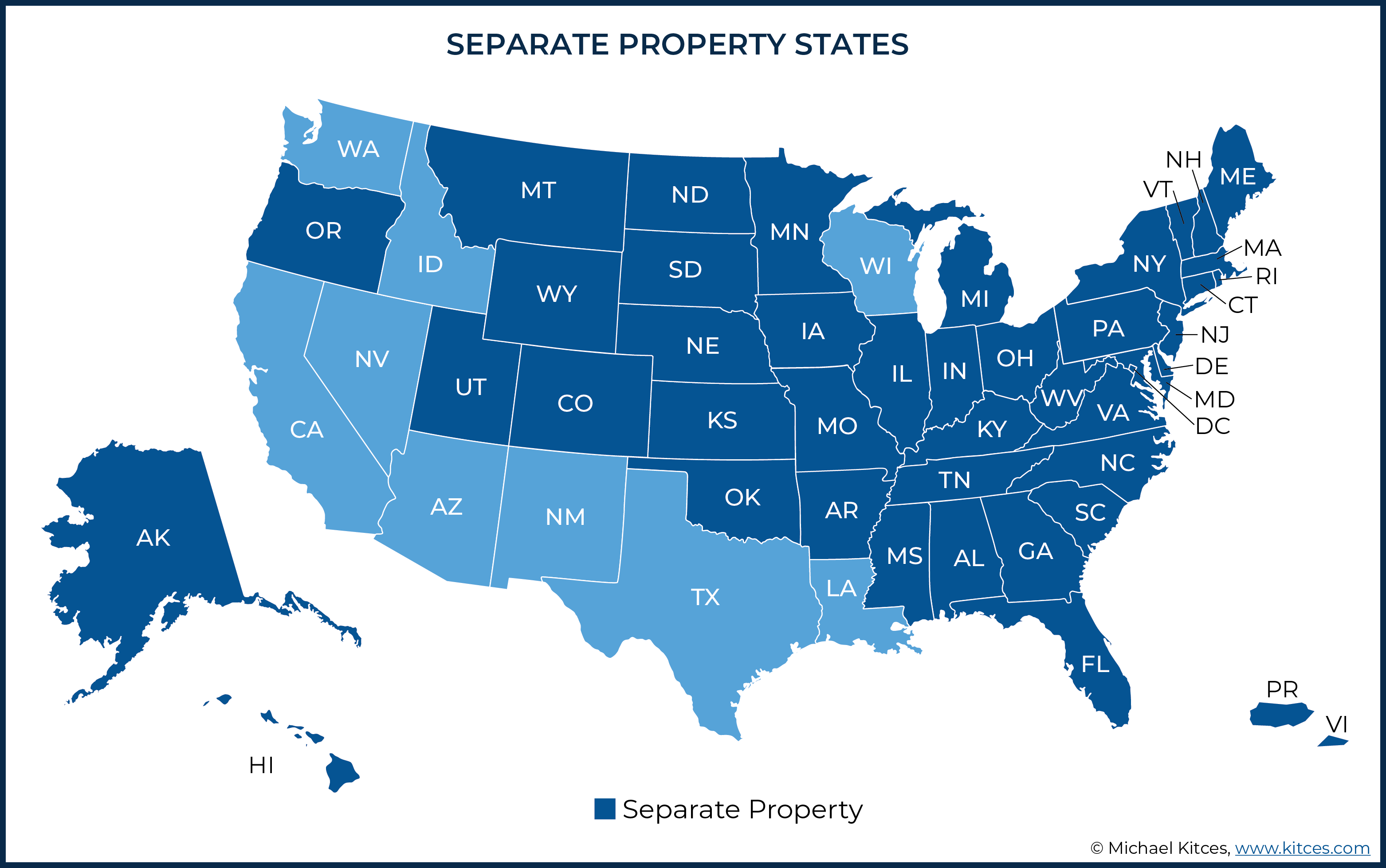

Inheritance - T-20 Affidavit of Inheritance required. However Georgia residents may still be on the hook for inheritance taxes if the state. A few states have disclosed exemption limits for.

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. Georgians are only accountable for federally-mandated estate taxes. Quickly find answers to your Inheritance tax questions with the help of a local lawyer.

The tax is paid by the estate before any assets are distributed to heirs. The sales tax exemption certificate is an important document that proves that you are exempt from paying sales tax. For married taxpayers living and working in the state of Georgia.

Tax rate of 2 on taxable income between 1001 and.

Guide To Selling An Inherited Home In Atlanta Georgia Breyer Home Buyers

South Carolina Vs Georgia Which Is The Better State

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Tax Comparison Florida Verses Georgia

Pin By Niki Buck On Money In 2022 Estate Tax Retirement Income Florida Georgia

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Estate Planning Attorneys In Atlanta Ga Best Estate Planning Lawyers In Atlanta

Creating Racially And Economically Equitable Tax Policy In The South Itep

Guide To Georgia Inheritance Law The Law Office Of Paul Black

A New Study Assesses Whether Inheritance Taxes Boost Net Revenues The Economist

Historical Georgia Tax Policy Information Ballotpedia

Georgia Retirement Tax Friendliness Smartasset

Estate Tax In Georgia Probate Cases Federal Inheritance Taxes

Georgia Estate Tax Everything You Need To Know Smartasset

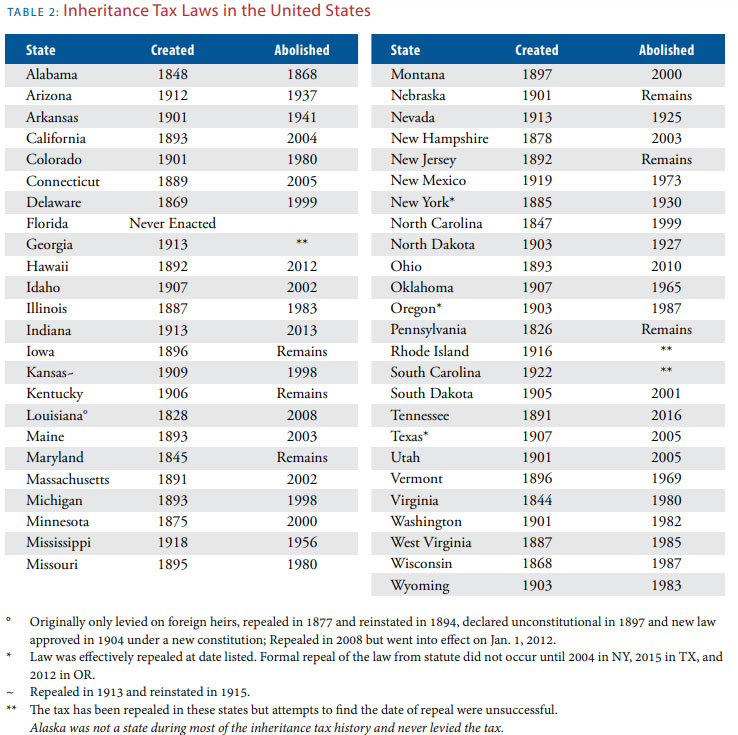

Death And Taxes Nebraska S Inheritance Tax

Georgia Taxation Of International Executives Kpmg Global